Louis Vuitton has just been named the official partner of the Formula 1 Australian Grand Prix 2025 - set to take place next month - marking the first activation of a nearly €100 million-a-year, 10-year partnership between LVMH and F1. CEO Pietro Beccari stated that the deal aligns with Louis Vuitton’s ambition to evolve from a luxury house into a "cultural brand".

At the SportsPro Summit in Madrid last November, which I had the opportunity to attend, Sara Pastor, SVP of Ad Media Sales at DAZN, highlighted the attractiveness of sports content as advertising inventory, stating that “sport has cultural relevance.”

This notion is reflected in Goldman Sachs’ recent report, "Unlocking New Opportunities in Sports," which describes the transformation of the industry as having “created a dynamic ecosystem that is integrated into our global culture like never before.”

Why does cultural capital - an inherently abstract concept - continue to emerge as a key factor in assessing the potential of sports and media franchises?

The fragmentation of the media ecosystem, shifting audience behaviours, and evolving fan engagement dynamics are fundamentally transforming the stakes for intellectual property (IP) owners - including sports organizations and major entertainment franchises.

Historically, major sports and entertainment IPs were built through television and mainstream media, which guaranteed mass reach and shaped fandom through a limited number of powerful distributors, such as movie theatres and TV networks. This allowed a select few sports leagues and entertainment brands to dominate popular culture, feeding and sustaining their status through "sheer ubiquity".

Today, the paradigm has shifted. Not only have the number of channels and media types exploded, intensifying competition among creators and distributors alike - often referred as the “attention economy” - but the discoverability of content is now driven increasingly by algorithms and user demand, rather than supply. This is evident not only on platforms like TikTok and YouTube but also on traditional media, where the move toward content de-linearization (e.g., SVOD, AVOD) places content awareness in the hands of users, rather than programmers.

The urgency becomes even clearer when considering the deflationary trend in monetization potential within the video and media distribution business, which has historically been the core revenue driver for entertainment and sports rights owners.

I won’t delve into this point in detail here, as it was the focus of a previous article on the NBA’s market positioning ahead of its recent rights auction.

However, the phenomenon is succinctly summarized in the following passage:

Starting point (pre cord-cutting):

- High volume: high penetration of Pay-TV bundles in households (close to 100% in 2010); large addressable market for broadcasters

- High value; price cross-subsidized across different audience sub-segments - even those not interested in sport - resulting in high affiliate fees for broadcasters

Development:

- Volume leakage ➜ churn effect: loss of value caused by non-fans and majority of casual fans who leave the bundle and do not re-subscribe for broadcasters’ sports streaming packages, as no willingness to pay/ switch on a stand-alone basis

- Value leakage ➜ down-sell effect: resubscription of core fans and some casual fans to sports streaming packages, but at lower value (streaming ARPU < Pay-TV bundle ARPU) and profit (higher streaming churn means higher CAC)

In short, the erosion of Pay-TV bundles and their respective ability to cross-subsidize content has affected the platform and unit economics of broadcasters and, ultimately, their ability to refinance sports media rights on a standalone basis (i.e. increasing right costs per subscriber).

Despite select tailwinds - for example, Disney's streaming segment achieved profitability for the first time in August 2024 - the urgency for IP owners to build business models that extend beyond video monetization becomes critical, as the pool of value is ultimately set to decline due to structural changes.

For major sports and entertainment IPs, cultural relevance is no longer a byproduct of media exposure. And it shouldn't be.

It requires more to stay culturally and economically relevant.

Defining cultural resonance

To clarify the core concept of this article, we will focus on cultural resonance rather than cultural relevance. The distinction lies in the dynamic versus static nature of the terms: cultural resonance captures the active, strategic process of forging a profound and enduring connection with audiences that resonates across contexts.

1. Beyond brand building:

Cultural resonance transcends brand building. Brand building is typically about awareness, often limited in scope and tactical in nature. By contrast, cultural resonance is about fostering a deep, emotional connection that goes far beyond simple recognizability. Take Barbie as an example: more than just a toy, Barbie is a cultural icon that resonates emotionally and generationally, influencing broader conversations about identity, beauty, and empowerment. This resonance drives engagement far beyond the product itself.

2. Fandom as a catalyst:

Cultural resonance is fundamentally powered by fandom. This includes both hardcore and casual fans, who collectively form a self-sustaining community that fuels ongoing conversations and engagement around the IP. This requires understanding and connecting deeply with distinct audience segments, reflecting their values, igniting their passions, and evolving alongside their interests.

3. A footprint in the mainstream:

However, simply engaging fan communities is not enough. To gain cultural resonance, an IP must transcend niche audiences and breaks into the mainstream - even if that means sparking polarizing opinions. Achieving pop culture status means being loved by many, hated by some, but considered by all.

3. Media engagement is the currency of resonance:

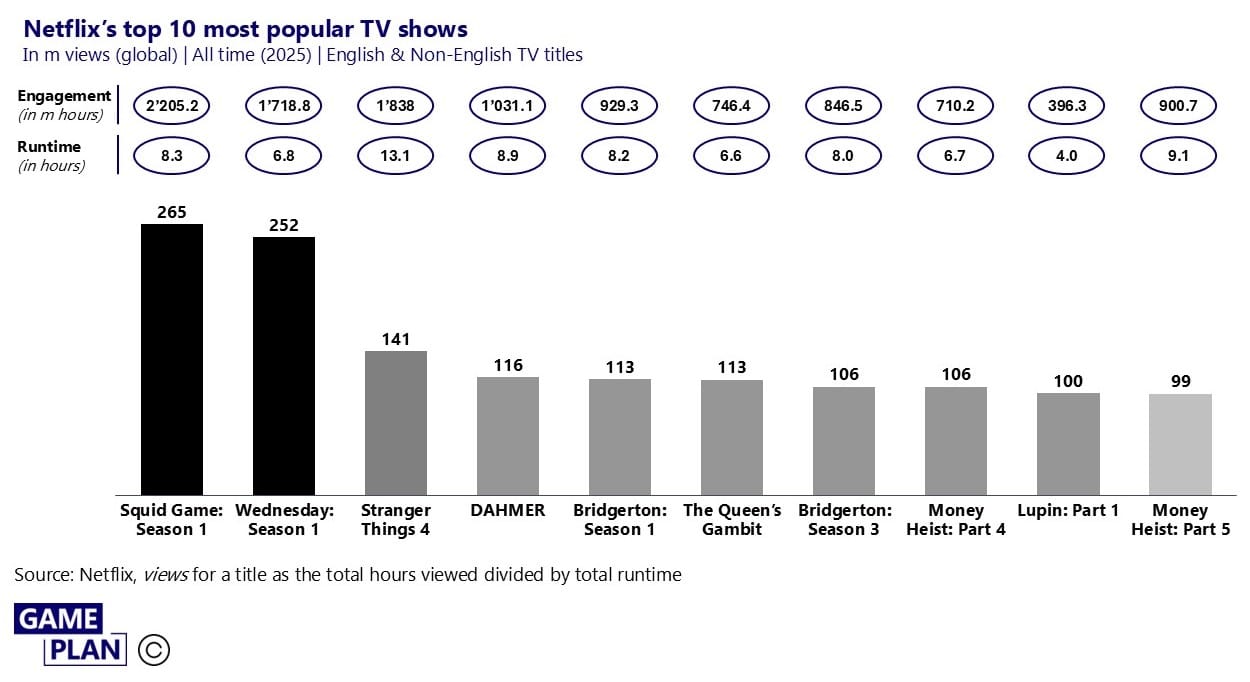

Typically, cultural resonance translates directly into media exposure and engagement. On platforms like Netflix, for instance, the most-watched shows often align with the highest levels of cultural resonance - shows that dominate discussions on social media, inspire memes, or reflect societal trends, creating an impact far beyond their viewership base (see chart below).

Examples include Squid Game’s viral social media memes and Halloween costumes, Wednesday’s iconic TikTok dance and its newly launched LEGO collection, and touring live experiences like Stranger Things: The Experience and Bridgerton: The Queen’s Ball. Even Money Heist’s Dali mask has become a global symbol of rebellion.

We can observe that Stranger Things 4 outperformed Stranger Things 3 in terms of viewership over the first 91 days, and Money Heist 4 surpassed Money Heist 3. While this can partially reflect differences in creative quality, it also highlights the growth of these properties into cultural phenomena, fostering fanbase building and rewatch value.

This evolution also introduces a new dimension - or 'KPI' - for evaluating a property’s potential: beyond acquisition value and retention value lies franchising value, which defines a show’s or movies’ potential for cultural leadership. While Netflix excels at predicting the first two, the third demands a more reactive approach, as hits in entertainment remain inherently difficult to predict.

4. Influence on lifestyle and (purchasing) behaviour:

Cultural resonance extends beyond media metrics to directly shape lifestyle choices and purchasing behaviour. It’s not just about driving conversations; it’s about embedding an IP into the real-world decisions of consumers. For instance, the Lord of the Rings films prompted global tourism to New Zealand.

5. Transferability:

Another defining characteristic of cultural resonance is its ability to transfer across domains, particularly when coherence exists between two properties. This is akin to sponsorship, where brands collaborate around shared values to trigger a transfer of attributes. This concept underpins the growing popularity of brand licensing and cross-industry collaborations in the sports, media, and entertainment sectors (select industry examples are explored in the second part of this article series).

At in all, the notion of cultural resonance represents a virtuous cycle - where a strong core fandom fuels broader cultural conversations, driving media visibility, engagement, and ultimately monetizable outcomes such as streaming views, merchandise sales, ad revenue, or ticket sales.

Cultural resonance as a driver of value creation

As Matthew Ball once articulated, an entertainment company creates stories, fosters love for those stories, and monetizes that love. More significantly, within the same service or product category, this love can command a pricing premium - for example, Disney Parks’ pricing compared to similar, non-themed park experiences.

Cultural resonance directly impacts value creation, including:

- Revenue growth through greater demand volume

- EBITDA margin driven by superior willingness to pay and commercial leverage

- Valuation multiples influenced by the above factors and further strengthened by a more favorable risk-return profile

Building cultural resonance: a pathway to growth

For video-driven IP owners, recent years, marked by the transition to streaming, have primarily been dedicated to a “vertical” transformation: striving to optimize their content distribution models for a new ecosystem. This has involved launching DTC (direct-to-consumer) and B2B2C channels and allocating significant budgets to better understanding fans through fan data strategies.

This transformation has fuelled the launch of proprietary streaming services as ‘destination platforms’ by IP owners.

However, the core challenge remains: no matter how well content distribution is optimized, the overall market for video continues to shrink. Most initiatives in the streaming transition have so far prioritized optimization over driving true growth.

Moreover, in today’s highly fragmented landscape, a siloed approach is insufficient. Relying on proprietary platforms and fan data typically addresses only lookalikes or similar demographics, missing the opportunity to cultivate fandom in untapped or adjacent communities (i.e., audience shaping).

A prime example of this shift is Apple, the ultimate proponent of a lock-in strategy, which is now increasingly moving away from controlling user access to services like video and music (e.g., integration of Apple TV+ and Music library’s with Canal+ and Amazon), demonstrating a willingness to relinquish direct control to achieve broader cultural impact.

Ultimately, it’s not about controlling users through vertical expansion; it’s about reaching and influencing users through cultural leadership, achieved via horizontal expansion.

From vertical to horizontal expansion

The concept of IP cross-pollination or multiplatform storytelling has been explored for a long time, though mostly in an opportunistic manner - driven by licensing partners seeking expanded rights to maximize monetization - with a fundamental focus on the bottom of the funnel.

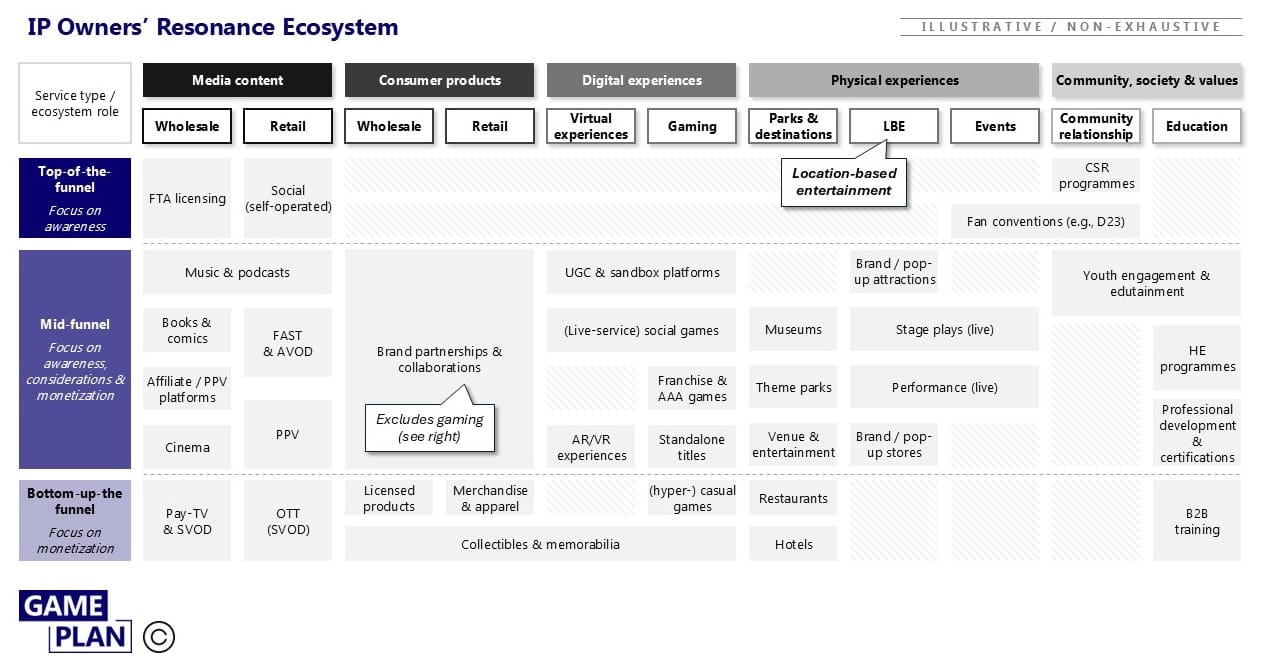

Achieving cultural resonance, however, requires a broader roadmap, both horizontally and vertically, across the funnel.

Awareness-driven services can be argued to contribute to generate cultural resonance, while conversion-driven services capture value from it - although some services may fulfil both functions.

For example, the new NBA Store on Oxford Street in London not only drives sales but, more importantly, reinforces the cultural relevance of the NBA as a lifestyle brand by connecting basketball with fashion. Its presence on one of the world’s most renowned shopping streets is a statement of cultural positioning.

The ultimate goal is to develop the most coherent mix of channels through a diversified set of services, each playing a distinct role in funneling users - from building awareness to driving conversion and monetization (Y-axis in the service ecosystem framework below).

Those services span from media content (core), consumer product, digital experiences, physical experiences, to community-oriented activations (X-axis in the service ecosystem framework below).

Becoming a “ubiquitous IP”

Recently, major pop culture IPs have embarked on various diversification initiatives, both as a defensive strategy to address headwinds in their core business and as an offensive approach to identify adjacent monetization opportunities and capitalize on the transferability of their assets.

This encompasses a wide range of licensing strategies:

- From cinema to AAA video games (e.g., Marvel’s Spider-Man, Star Wars Jedi, Batman: Arkham)

- From AAA video games to TV (e.g., Halo, The Last of Us, Arcane)

- From live music entertainment to consumer goods (e.g., Ibiza’s Ushuaia Store)

- From sportswear and footwear to events (e.g., Adidas Arena) and cross-category consumer goods (e.g., partnership between Nike and Lego)

- From luxury retail to food (e.g., Louis Vuitton restaurants)

- From sports to entertainment events (e.g., rumour of Rugby’s new touring league)

- …

Beyond licensing and strategic partnerships, this trend is becoming increasingly evident from an M&A perspective.

Last year, Bain reported that more than 50% of media and entertainment deals involved either an asset or investor from outside the industry, highlighting a broader shift in strategy. This reflects Disney’s evolution from “scale” acquisitions (e.g., Lucasfilm, Pixar, Marvel Studios) - vertical expansion in our framework - to “scope” acquisitions (e.g., Epic Games) - horizontal expansion aimed at diversifying its ecosystem.

This shift is also apparent from a corporate strategy and organizational standpoint, with the establishment of new, "beyond media" divisions such as Sony Pictures Experiences and Warner Bros. Discovery Global Experiences.

Allocating the right delivery model to each service opportunity

When building their ecosystem of services, IP owners must not only determine what to pursue but, even more importantly, how to execute it effectively.

Both dimensions come with significant optionality, and with it, considerable complexity.

Ironically, in recent years, major IP owners have concentrated their strategies around a specific operating model - most notably DTC streaming - which, when it comes to achieving horizontal expansion, is restrictive rather than enabling.

Instead, the strategic focus should be on developing a comprehensive “toolbox” of diverse operating models that enable penetration into specific verticals and exploitation of certain services (e.g., self-operated, strategic partnerships, franchising/licensing) in the most financially viable way. This question of licensing vs. retaining rights - a fundamental issue in media distribution and relevant across every vertical in the ecosystem - must be continuously assessed and reassessed to optimize impact and profitability.

In most diversification cases, the most effective routes involve inorganic growth through M&A - even if scope deals often make cost and revenue synergies difficult to define - or strategic partnerships with best-in-class vendors, rather than directly operating new business areas.

Navigating diversification while driving coherence: the ultimate challenge

Yet the challenge lies not only in ensuring coherence in capabilities but also in selecting the right mix of services to target - those where a sports or entertainment company has the greatest 'right to win.' A 'right to play' is not sufficient.

I’ve previously quoted Reed Hastings, founder and co-CEO of Netflix, who advocates for coherent diversification rooted in core capabilities:

“We have to be differentially great at it. There’s no point of just being in it”

A crucial aspect of creating a mutually reinforcing service ecosystem roadmap is fostering synergy between channels and services.

This synergy should revolve around common themes that define the DNA of the IP’s identity (e.g., design for Louis Vuitton) and strike a balance between engaging core fans and tapping into new communities where the IP owner identifies an entry point through some shared attributes or values.

I am quoting Bob Iger here - again - from his MasterClass to embody this idea:

Consumers, faced with myriad decisions each day, are able to cut through the noise by recognizing your brand and sticking with your product. They form an opinion about you once, and as long as you don’t betray that trust, their familiarity with the brand simplifies their decision-making process.

Does every product under your brand umbrella embody these values? If not, you’ll either need to rethink your unifying set of values or (more likely) adjust your products to universally support your brand. Once your products clearly align with your brand values, you’re golden.

Ultimately, cultural leadership isn’t about leading in products or services; it’s about leading in perception around select themes, which in turn translate into product and service opportunities.

In the next article series, we will explore notable examples of how this approach is being actually implemented.