In the sports industry, 2024 was marked by several media rights deals that stood out due to their relatively unprecedented nature:

- Netflix acquiring global rights for NFL Christmas Day games as part of a three-season deal

- The NBA’s media rights agreement for the 2025-26 to 2035-36 seasons (11 years), with key partners Disney, NBC, and Amazon gain domestic rights as well as rights to several international markets. These international rights are allocated strategically based on the partners’ presence and assets, such as Disney+ in select markets in Asia and Europe, NBC’s Sky Sports channels in Europe, and expanded content packages for Amazon in select territories

- DAZN acquiring global rights for the 2025 FIFA Club World Cup

- Netflix securing U.S. rights for the 2027 and 2031 FIFA Women’s World Cups

- ...

These deals resonated strongly in the industry as, in many ways, they materialized market signals and trends that had been anticipated for some time (e.g., Apple-MLS deal announced in 2022).

While most discussions have focused on the buy-side, such as the establishment of new players like Netflix in the marketplace for live sports or DAZN’s evolution into a global media group, this article aims to briefly explore the key sell-side implications for sports rights owners.

2024: firm steps toward market (re)consolidation

Fundamentally, 2024 marked a definitive move toward market consolidation after years of peak fragmentation in the media industry. This shift is evident in several ways:

- Content partnerships within rights buyers: Content-sharing and carriage / sub-licensing agreements have already been significantly utilized over the past years, particularly in Europe – with the trend continuing to grow alongside the emergence of new models like affiliate partnerships (e.g., DFL and OneFootball)

- Bundling and joint offering: Integration at product level versus content level

- The internationalization and consolidation of rights buyers: Netflix, YouTube, and Amazon are continuing to expand their global footprints; DAZN has acquired Foxtel; Warner Bros. Discovery is rolling out MAX internationally; Canal+ has entered the Hungarian market, etc. Similar to globalization trends in many sectors, local Pay-TV markets within specific geographic zones are beginning to converge and resemble one another, although this trend is still in its early stages

- Streaming profitability: Major streaming services achieved record profitability levels in 2024, reflecting not only the maturation of their business models but also an increased commercial leverage among key players driven by reduced competition, ultimately leading to higher pricing power, lower customer acquisition costs, and lower churn

For sports rights owners navigating media rights sales and renewals in the coming years, these trends offer new opportunities but also bring unprecedented managerial complexity.

Rights owners’ historical trade-off: money vs. exposure

Historically, the key strategic area for sports organizations selling media rights has revolved around content allocation, particularly in navigating the trade-off between money and exposure. This involves balancing greater exposure and enhanced content discoverability via Free-to-Air (FTA) channels - which foster fanbase growth and increase sponsorship value - against the higher revenues typically offered by Pay-TV deals, which can be more lucrative.

This trade-off is closely tied to partner selection, traditionally managed through a market-by-market approach to rights sales. In some cases, rights holders work with third-party agencies for select markets, but even then, agencies typically conduct sales on a country-by-country basis.

This process requires proactive content packaging and tender strategies developed ahead of the tender process to steer outcomes toward the ideal scenario, including considerations around channel and platform exclusivity.

A relevant example is the need for platform-agnostic rights, enabling rights owners to distribute content not only through traditional TV platforms but also via digital channels, which have become increasingly essential.

Ultimately, the trade-off between content allocation and revenue, along with packaging and tender strategy, remains a critical area of strategic focus for sports rights owners today.

The rise of DTC and an expanded buyer universe

Another layer of complexity emerged with the strategic imperative for rights owners to gain deeper knowledge and greater control over their audiences. This led many organizations to launch self-operated content distribution channels, either:

- Fully owned (the so-called OTT model)

- Through third-party platforms (e.g., social video or Recast)

In the buyer market, this shift has coincided with the end of the era dominated exclusively by traditional TV (and telco) players, paving the way for a new landscape of fragmented buyer profiles. These now include a mix of incumbents and emerging players, such as pure-play streaming services and global technology groups.

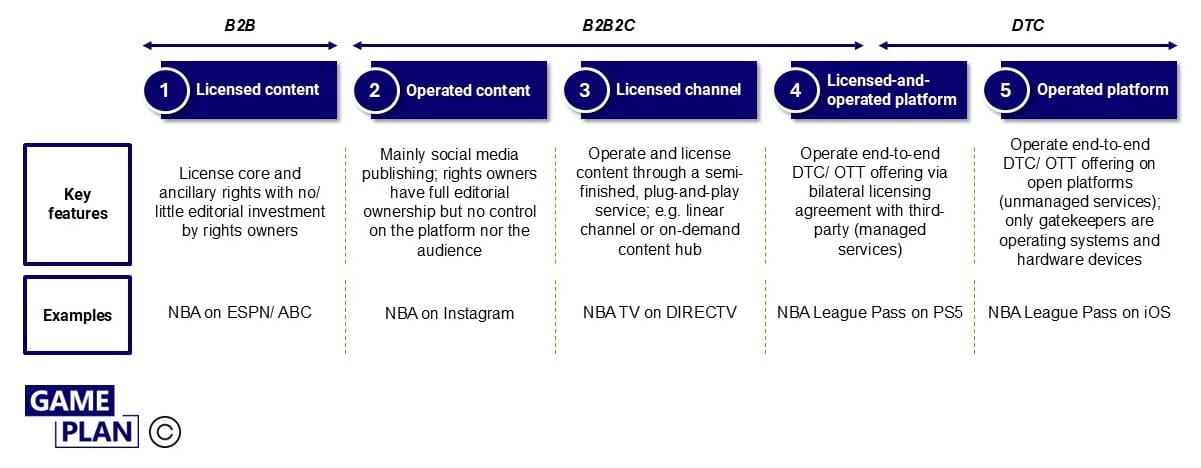

This shift has introduced greater complexity, not only in rights activation (deciding which rights to license versus retain) but also in the level of services provided to current and prospective licensees. These value-added services - such as fully produced live content with localized commentary - are essential for facilitating rights monetization and supporting new entrants, particularly those lacking core media capabilities and seeking plug-and-play solutions.

We previously summarized these implications in a framework on the NBA’s recent rights sales process:

Rights activation and the prioritization of value-added services remain critical areas of strategic decision-making for rights owners.

New market structure bringing on new challenges

In 2024, one could argue that market consolidation driven by international or global players has propelled media rights distribution into a new era. In this context, licensing opportunities increasingly see buyers pushing for content rights that can be leveraged internationally across their key markets.

As a result, the sales approach may shift from a market-by-market model for global events, and a domestic tender vs. international go-to-market approach for leagues - with some exceptions for pan-regional tenders in regions dominated by single players, such as beIN in MENA - to a new dynamic that includes:

- A principal tender process, typically focused on global and international buyers, and

- A residual tender process, generally targeting more local partners, depending on the remaining rights flexibility after (international) content allocation to main partners

Depending on the packaging structure and the exclusivity terms, the potential outcomes can be numerous:

- One exclusive global partner (e.g., Apple & MLS, DAZN & FIFA Club World Cup)

- One major global partner + several international partners

- One major global partner + national partners

- Several international partners only

- Several international partners + national partners (e.g., NBA)

- Mostly national partners (e.g., UEFA Champions League)

- …

A growing stack of complexity

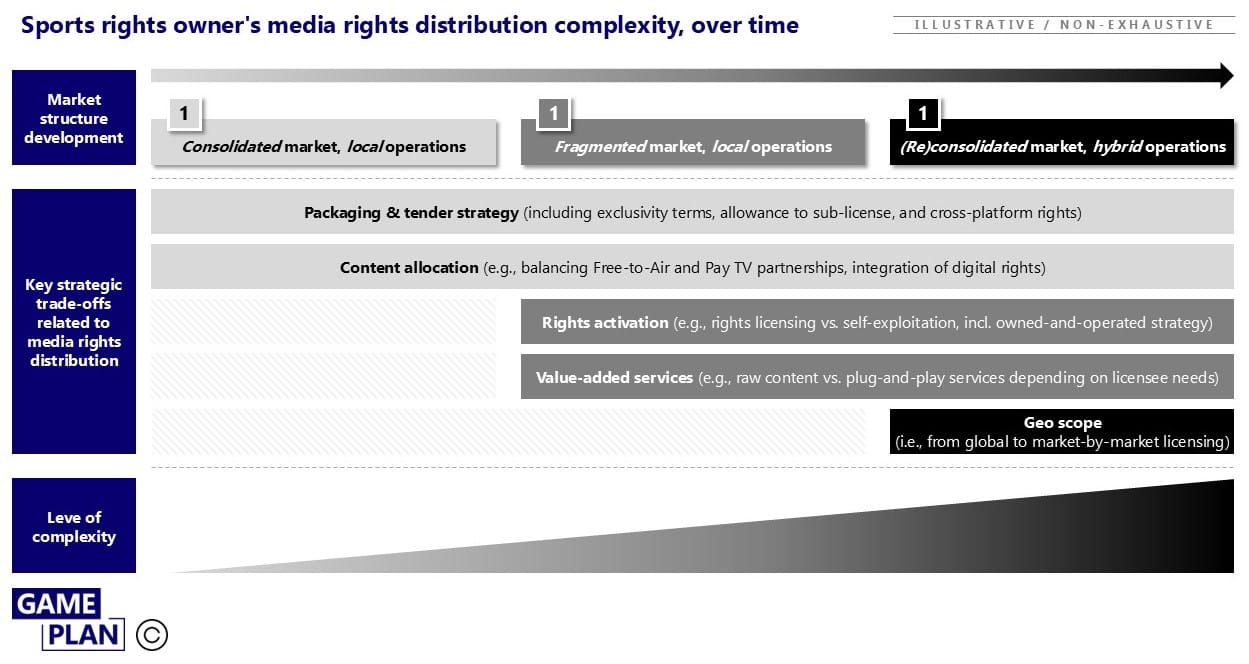

All in all, we can observe that for sports rights owners the evolution of the market structure in recent years has steadily increased the complexity of managing and optimizing media rights exploitation.

This strategic complexity has unfolded gradually, starting with packaging structure and content allocation, progressing to rights activation and service needs, and now expanding to include geographical scope as an additional dimension, as illustrated in the framework below:

This is all the more challenging because each strategic dimension has dependencies on the others, making it reasonable to argue that complexity has increased exponentially rather than incrementally.

Looking ahead, key strategic questions include:

- How to optimize content allocation across owned services and licensed platforms, taking into account available inventory and fanbase needs

- How to leverage owned services to enhance licensing operations, whether tactically (e.g., applying pressure in rights auctions) or strategically (e.g., complementing property promotion and expanding content coverage)

- For licensed content, what value-added services (e.g., content localization) to develop and offer to current and prospective licensees to facilitate rights refinancing or stimulate market entry for new buyers - both of which contribute to maximizing the value of the rights

- How to package rights and structure tenders to align with market structure and optionality, particularly regarding geographical scope (e.g., one main ‘hybrid’ tender vs. separate domestic and international approach)

- What are the preferred scenarios, including trade-offs between revenue, exposure and content discoverability, as well as managing partner relationships (e.g., facilitating new entrants versus protecting incumbents)

- How to steer the auction process toward achieving the preferred scenario

For rights owners entering the market in 2025, it is fair to say that authoritative answers to these and other critical questions will be essential to fully capitalize on market trends while minimizing the risk of value leakage.